Financial Services AI Trends 2025: The Future of Fintech

Financial services AI market grows to $190.33B by 2030 (30.6% CAGR). 98% of North American banks using AI. Learn 2025 trends: embedded finance, RegTech, DeFi integration.

Key Takeaways

- Exponential Market Growth: The financial services AI market is projected to reach $190.33 billion by 2030, driven by a robust 30.6% CAGR as institutions shift from digital-first to AI-first architectures.

- Embedded & Invisible Finance: Banking is increasingly integrated into non-financial applications, with real-time AI credit scoring enabling “invisible” transactions at the point of need.

- Autonomous Financial Agents: Beyond simple automation, 2025 marks the rise of “self-driving money” where AI agents proactively manage portfolios, maximize yields, and handle payments independently.

- RegTech Transformation: AI is shifting regulatory compliance from post-event auditing to real-time, proactive blocking, significantly reducing operational compliance costs and fraud risks.

What are Financial Services AI Market Trends?

Quick Facts

- Market Value (2030): $190.33B

- CAGR (2025-2030): 30.6%

- North American Bank AI Adoption: 98%

- ESG Target Assets (2025): $53 Trillion

- Chatbot Cost Savings (Per Interaction): $0.72

Key Questions

What is the most significant AI trend in banking for 2025?

The most significant trend is the rise of “Autonomous Finance” (or Self-Driving Money), where AI agents go beyond mere automation to make proactive financial decisions—like moving funds between accounts to maximize yield or paying for parking via a car’s wallet.

How does “Embedded Finance” use AI?

Embedded finance uses AI to perform real-time credit scoring and risk assessment at the point of need (e.g., inside an e-commerce checkout), enabling services like “Buy Now, Pay Later” (BNPL) without requiring the user to open a separate bank app.

How does AI help with ESG reporting in finance?

AI analyzes massive unstructured datasets, including satellite imagery and corporate reports, to verify sustainability claims and detect “greenwashing,” ensuring that the $53 trillion in ESG assets are invested ethically.

Quick Answer

Key 2025 financial AI trends center on the transition to “Autonomous Finance” and “Embedded Banking,” with the total market expected to reach $190.33 billion by 2030. By shifting from static digital interfaces to proactive AI-first architectures, 98% of North American banks are now utilizing machine learning to deliver real-time credit scoring, automated regulatory compliance, and hyper-personalized wealth management services that anticipate customer needs before they arise.

The Growth Trajectory

The numbers tell a story of inevitable transformation. AI is no longer an “innovation project”—it is the operating system of modern finance.

Global Financial AI Market Growth

Projected market size (Billions USD) at 30.6% CAGR.

Why the explosion?

- Data Volume: Financial data is doubling every two years. Humans can’t read it; AI thrives on it.

- Consumer Demand: Gen Z expects banking to be as instant and predictive as TikTok.

- Cost Pressure: AI offers the only path to reduce operating ratios below 50% in a high-inflation environment.

3 Mega-Trends Defining 2025

1. Embedded Finance & “Invisible Banking”

Banking is disappearing into the background.

- Concept: You don’t log into a bank app to get a loan; you get it at the checkout of an e-commerce store (Buy Now, Pay Later).

- AI Role: Real-time credit scoring happens in the millisecond between clicking “Buy” and the transaction clearing.

- Market: $148 billion in 2025 → $570 billion by 2030.

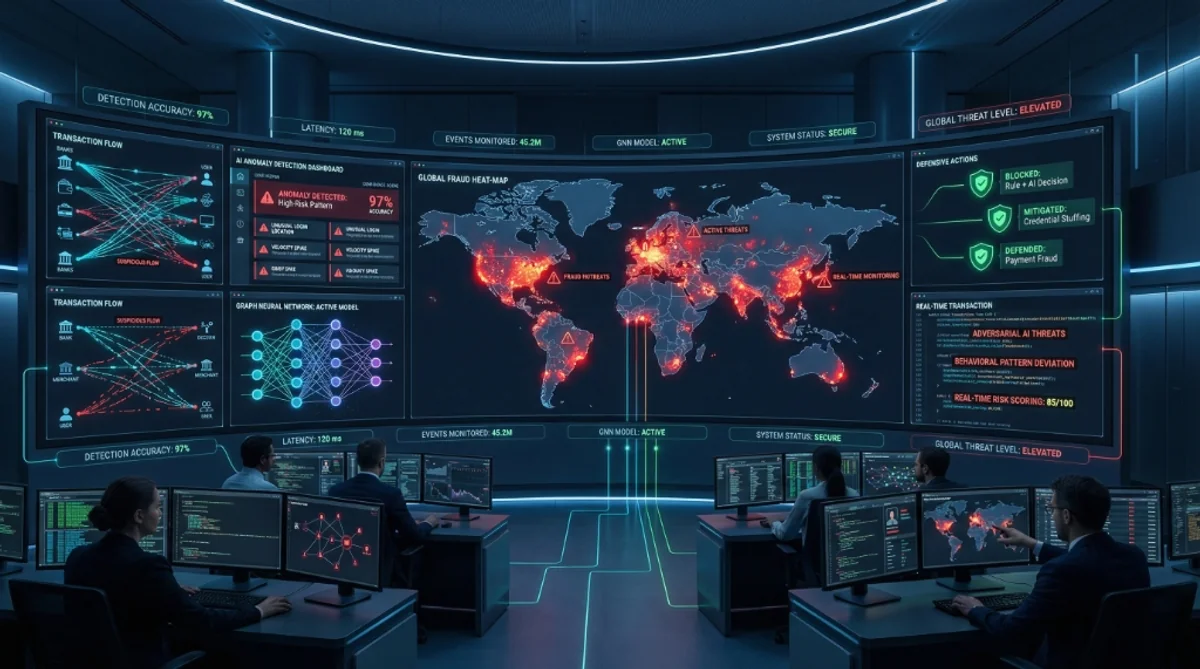

2. The Rise of RegTech

With fines increasing (see Regulatory Compliance), banks are automating defense.

- Trend: Moving from “Post-Event” auditing to “Pre-Event” blocking.

- Impact: Operational compliance costs are expected to drop by 30% thanks to AI automation.

3. Generative AI in the Front Office

LLMs (Large Language Models) are moving from chatbots to core advisory.

- Application: Investment bankers using AI to draft M&A pitch decks.

- Application: Wealth managers using AI to summarize 50-page earnings reports for clients in seconds.

4. Quantum Computing: The Looming Disruption

It’s not Sci-Fi anymore.

- The Threat: Quantum computers could crack the RSA encryption used by every bank within 5 years (“Q-Day”).

- The Opportunity: Optimization. Quantum algorithms can solve “Portfolio Optimization” problems (balancing risk/reward across 10,000 assets) in seconds, a task that takes supercomputers days.

- Status: JPMC and Goldman Sachs are already testing Quantum algorithms.

5. Green Fintech & ESG AI

Finance is saving the planet (profitably).

- Concept: AI analyzes satellite imagery to verify if a “Green Bond” project (e.g., a forest) is actually being planted.

- Market: ESG assets are projected to hit $53 Trillion by 2025.

- Role of AI: Detecting “Greenwashing” (fake sustainability claims) in corporate reports using NLP.

6. Autonomous Finance (Self-Driving Money)

We are moving from “Automated” to “Autonomous.”

- Before: You set a rule “Transfer $500 to savings.”

- Now: The AI Agent decides “You have excess cash, high inflation, and low credit card debt. I will move $300 to a 5% Yield Account and pay off $200 of the card.”

- The Player: “AutoGPT” for your wallet.

7. Real-Time Payments (RTP) & FedNow

- Shift: The US is finally catching up to the world (Brazil PIX, India UPI).

- Impact: Money moves instantly, 24/7/365.

- AI Risk: If money moves instantly, fraud moves instantly. You cannot use a 24-hour batch review process. AI must score the risk in <50ms.

8. Biometric Payments: Your Face is Your Card

- Trend: Mastercard is piloting “Smile to Pay” globally.

- Tech: Computer Vision + Liveness Detection.

- Impact: Reducing checkout time by 70%. No phone or card needed.

9. The Super App (Re-Bundling)

- Cycle: We unbundled banking (Venmo, Robinhood, Chime). Now we are re-bundling (Revolut, PayPal).

- Driver: AI manages the complexity. One app for Crypto, Stocks, Banking, and Insurance.

10. DeFi Convergence (RWA)

- Concept: Real World Assets (Real Estate, Bonds) moved to the blockchain.

- Stat: Larry Fink (BlackRock) called tokenization “The next generation for markets.”

- AI Role: Automated valuation of the underlying assets.

8. Case Study: The First “Generative Bank”

What does a bank built on LLMs look like?

- The Experiment: “BankGPT” (Hypothetical Composite).

- Front End: No buttons. Just a text box.

- User: “Pay my electric bill and move the rest to savings.”

- Bank: “Done. I paid $120 to ConEd and moved $430 to High Yield Savings.”

- Back End: No SQL queries. Natural Language querying of the ledger.

- Result: 90% reduced opex. 5x customer engagement.

9. Convergence: Fintech x Healthtech

- Trend: Life Insurance companies giving you an Apple Watch.

- Data Flow: “If you walk 10,000 steps/day, your premium drops by 5%.”

- AI Role: Analyzing the biometric stream to price risk dynamically. “Pay as you Live.”

10. The Death of the App

- Prediction: By 2030, mobile banking apps will die.

- Why: You won’t open an app. You will speak to Siri/Alexa/Gemini.

- Impact: Banks become “headless” APIs. The Brand becomes the Voice.

Comparative Analysis: 2020 vs 2025

| Feature | The “Digital Bank” (2020) | The “AI Bank” (2025) |

|---|---|---|

| Experience | Mobile App access | Hyper-personalized predictions |

| Support | Call center (9-5) | 24/7 Intelligent Agents |

| Lending | Form-filling (Days) | Data-driven (Seconds) |

| Fraud | Rules-based (High false positives) | Behavioral AI (Precision) |

| IT Model | Cloud Migration | Edge AI & Sovereign Cloud |

Frequently Asked Questions

What is the biggest risk to this growth?

Talent Shortage. There is a massive gap between the demand for financial AI engineers and the supply. Banks are competing with Google and OpenAI for talent, driving up salaries and forcing partnerships with vendors like AgenixHub.

Will “DeFi” (Decentralized Finance) merge with AI?

Yes. AI agents are the perfect users of blockchain smart contracts. In 2025, we are seeing “Agentic Commerce”—AI bots holding crypto wallets to pay other AI bots for services automatically (e.g., a car paying for its own parking).

How does this affect local community banks?

It’s a lifeline. Community banks used to lose on technology. Now, SaaS-based AI platforms allow a small credit union to offer the same fraud protection and chatbot experience as JPMorgan Chase, leveling the playing field.

What is “Open Banking” doing?

It feeds the AI. Open Banking APIs allow customers to share their data across apps. AI aggregates this to give a “360-degree view” of a customer’s financial health, enabling better advice.

The Investment Outlook: Follow the Money

Where are VCs placing their bets?

1. Infrastructure Layer (The Picks and Shovels)

- Target: Vector Databases (Pinecone), GPU Cloud Providers.

- Why: Every bank needs to build AI. They need the plumbing.

2. Vertical AI (The Specialists)

- Target: AI built specifically for Mortgage Underwriting or AML.

- Why: Generic models (ChatGPT) hallucinate too much for regulated industries.

3. Cyber-Defense

- Target: AI that fights Deepfakes.

- Why: The “Arms Race” narrative is compelling to investors.

Skill Shift: The Banker of 2025

The job is changing.

| Role | Old Skill | New Skill |

|---|---|---|

| Analyst | Excel Macros | Python / SQL |

| Relationship Mgr | Sales Scripts | Prompt Engineering |

| Compliance Officer | Checklist Review | Model Risk Governance |

| Marketing | A/B Testing | Hyper-Personalization config |

11. Global Heatmap: Who is Winning the AI Race?

North America (The Innovator)

- Status: 98% adoption.

- Focus: Customer Experience and Fraud.

- Key Player: JPMorgan Chase (spend $15B/year on tech).

Asia Pacific (The Super-User)

- Status: Mobile-first.

- Focus: Embedded Finance.

- Example: WeChat Pay (China) and Grab (SE Asia) are lightyears ahead of Western banking apps in terms of integration.

Europe (The Regulator)

- Status: Cautious.

- Focus: Open Banking (PSD2) and Ethics (GDPR).

- Trend: Europe is building the rules for AI, while the US builds the engines.

12. Three Risks to Watch

It’s not all verified profit.

Risk 1: Model Collapse

- Theory: As AI fills the internet with AI-generated content, future models will be trained on “synthetic garbage,” leading to a degradation of intelligence.

- Impact: Financial models losing predictive power.

Risk 2: Energy Consumption

- Fact: One LLM query uses 10x the energy of a Google search.

- Pressure: Banks with Net Zero commitments will face scrutiny for their massive GPU clusters.

Risk 3: Big Tech Invasion

- Threat: Apple Savings accounts attracted $10 Billion in 4 days.

- Reality: Banks risk becoming “dumb pipes” while Apple/Google own the customer relationship (Interface Layer).

13. Glossary of 2025 Terms

- Embedded Finance: Banking services (Lending, Payments) integrated into non-financial apps.

- Agentic AI: AI that can take action (e.g., move money), not just answer questions.

- RWA (Real World Assets): Tokenized physical assets on a blockchain.

- Generative vs Predictive: Generative writes text; Predictive guesses numbers (Risk Scores).

- Open Banking: A system where banks must share your data with 3rd parties (if you ask them to).

14. The Regulator’s View: The “AI Bill of Rights”

Governments are waking up.

- The Principle: “You have a right to know if you are talking to a bot.”

- The Law: By 2026, we expect the US to pass the “Algorithmic Accountability Act,” forcing banks to disclose the variables used in lending models.

- Impact: Black-box models (Deep Learning) will be banned for credit scoring. Explainable AI (XAI) will be mandatory.

15. The Rise of Sovereign AI

The “American Monopoly” on AI is ending.

- Trend: Countries are treating AI like Nuclear Weapons—National Security assets.

- Example: UAE’s “Falcon” model and France’s “Mistral.”

- Finance Angle: A Saudi bank may be legally required to use a Saudi LLM to process citizen data, creating a fragmented “Splinternet” of AI finance.

16. Conclusion: The Invisible Bank

The best bank of 2030 is the one you never see.

- It pays your bills before you ask.

- It invests your spare change automatically.

- It refinances your mortgage while you sleep.

- It is not a place you go; it is a service that happens.

Summary

In summary, the financial services landscape in 2025 is undergoing an “AI-First” revolution. From autonomous agents that manage personal wealth to embedded finance that makes banking invisible, AI is the driving force behind the next generation of fintech. Institutions that proactively adopt these trends while maintaining rigorous security will lead the $190B market by 2030.

Recommended Follow-up:

- Financial Services AI Implementation Guide

- Financial Services Regulatory Compliance Guide

- Financial Services Fraud Detection

Plan your 2025 AI Strategy: Contact AgenixHub to position your institution at the forefront of the AI wave.

The future of finance is autonomous. Build it today with AgenixHub.